Asset Depreciation is the core of accounting practices, and the depreciation rate of Fixed Asset varies in different countries, subjected to the local regulation.

In Malaysia, traditionally, many SME in Malaysia are using the manual journal entry posting , to be posted on monthly basis, because many local Accounting software doesn't support the automatic posting of the depreciation entries.

Example of the Manual Journal Entries are as follow:

Eg, Computer with 20% depreciation rate (straight line)

a) Upon purchase of the Computer that cost RM6,000.

DR RM6,000 Office Equipment Asset Account

CR RM6,000 Bank

b) Depreciation of RM100 (RM6,000 / 5 Years / 12 months) at each month end for 60 months

DR RM100 Depreciation Expense Account

CR RM100 Office Equipment Asset Account

Benefits of Using Odoo Asset Management

1) Time saving without having to post to journal entries on monthly basis.

2) Reduce human error in manual posting.

3) Easy to compute the Savage value, when intended to sell the asset.

The following is how the Asset Depreciation is working in Odoo CE with Asset Management:

a) Create an asset Type. Select the Asset Account and Depreciation Expense Account.

Linear = Straight line (same depreciation amount for the entire useful life).

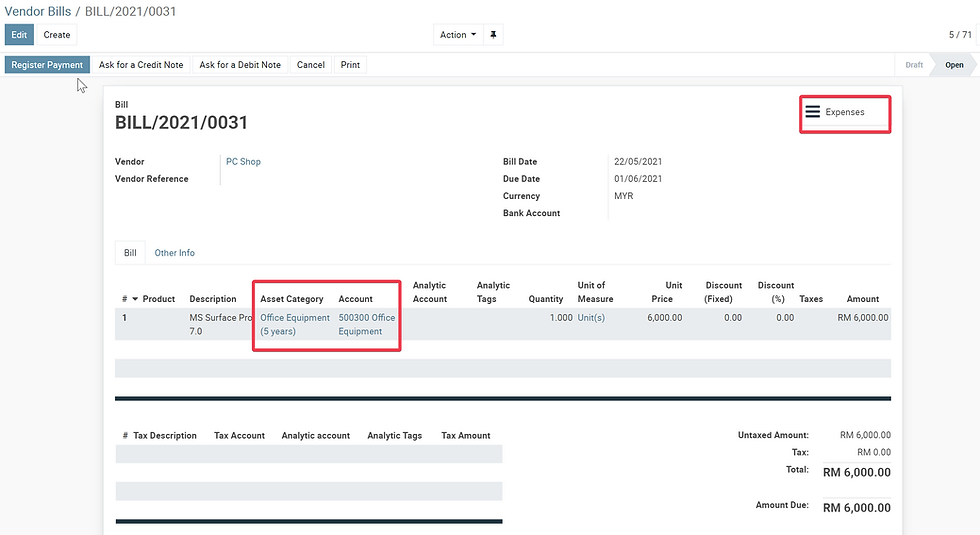

b) Create a vendor bill and select the Asset Category and Asset Account.

Upon validation, an asset will be created.

c) An Asset with the journal entries will be created.

On each month end, the journal entry will be posted.

Example of the journal entry.

Click "Like" at the bottom of this blog, to motivate us to continue sharing more Odoo tips.

Comments